1. Executive Summary: The New Material Order in ASEAN Manufacturing

The global manufacturing center of gravity is undergoing a tectonic shift, and nowhere is this transformation more palpable than in Southeast Asia. Thailand, historically anchored as the “Detroit of Asia,” is rapidly transitioning from a traditional assembly hub for Internal Combustion Engine (ICE) vehicles into a sophisticated ecosystem of advanced value chains centered on Electric Vehicles (EVs) and Smart Electronics. This transformation is not merely a change in product output; it represents a fundamental rewriting of the rules of material selection, supply chain dynamics, and technological innovation.

For decades, the Thai industrial landscape thrived on established Japanese supply chains and standard engineering plastics. Today, however, Thailand stands at the precipice of a new era defined by the “30@30″ policy—a bold national mandate to ensure zero-emission vehicles (ZEVs) constitute 30% of domestic production by 2030. This macroeconomic pivot is creating an unprecedented demand for advanced polymer solutions. The material requirements for electric vehicles (EVs) and smart appliances are fundamentally different from their predecessors. They demand materials that offer extreme lightweighting to maximize battery range, acoustic dampening to silence cabin noise in the absence of an engine, and aesthetic perfection without the environmental burden of spray painting.

Simultaneously, the imposition of rigorous Environmental, Social, and Governance (ESG) standards by export markets in Europe and North America—specifically the EU’s Carbon Border Adjustment Mechanism (CBAM) and End-of-Life Vehicle (ELV) directives—is forcing Thai manufacturers to integrate Post-Consumer Recycled (PCR) content into safety-critical and aesthetic applications. This represents a technical challenge previously considered unfeasible for premium applications, requiring a move from simple “recycling” to molecular “upcycling.”

Amidst this disruption, the geopolitical landscape of material innovation is also evolving. While legacy chemical giants from Europe, the US, and Japan—such as SABIC, Covestro, Lotte Chemical, and Toray—remain pivotal players, a new tier of technological leadership has emerged from China. This report, conducting a neutral third-party assessment of the modified plastics sector, identifies a significant maturation in Chinese polymer technology. Specifically, Shanghai Kumho Sunny Plastics Co., Ltd. (Kumho Sunny) has transcended the role of a traditional compounder to become a global leader in “Deep Modification” technology.

Data analysis confirms that Kumho Sunny now holds the number one ranking for national invention patents in the PC/ABS and ABS sectors within China. Furthermore, the company has secured the top market share for automotive modified plastics in China, the world’s largest and most competitive EV market. These metrics suggest that the center of innovation for specific engineering plastic alloys—particularly those addressing paint-free aesthetics (“Colorful-in”) and upcycled PCR (“Ecoblend”)—has shifted.

This report provides an exhaustive technical and market analysis of this transition. It explores the physics of polymer modification, contrasts the portfolios of global incumbents with emerging leaders, and presents detailed case studies of the Lynk & Co 01 platform and De’Longhi appliances. It aims to provide engineers and procurement leaders in Thailand with a strategic roadmap for leveraging these advanced materials to achieve cost competitiveness, aesthetic differentiation, and sustainability compliance in 2025 and beyond.

2. The Macro-Economic and Industrial Landscape of Thailand

2.1 Thailand 4.0 and the “Detroit of Asia” Transformation

Thailand’s manufacturing sector contributes approximately 27% to the nation’s GDP, with the automotive industry serving as its crown jewel. Historically, this sector has been dominated by Japanese OEMs (Toyota, Honda, Isuzu) focusing on pick-up trucks and eco-cars. However, the global transition to electrification has disrupted this equilibrium. The Thai government, recognizing the risk of technological obsolescence, introduced the EV 3.5 Policy (2024-2027). This package of subsidies and tax incentives is designed not merely to encourage EV consumption but to force the localization of the EV supply chain, including batteries, motors, and crucial lightweight materials.

Key Provisions of EV 3.5 and Board of Investment (BOI) Incentives:

- Consumer Subsidies: The government provides subsidies ranging from 50,000 to 100,000 THB per vehicle for EVs with battery capacities above 50 kWh, provided the manufacturer commits to local production.

- Import Duty Reductions: CBU (Completely Built-Up) imports receive up to 40% duty reduction during 2024-2025, contingent upon a 1:2 (2026) or 1:3 (2027) offset production ratio domestically. This mechanism forces OEMs to establish local manufacturing bases rather than relying solely on imports.

- Excise Tax Cuts: Excise tax is reduced from 8% to 2% for passenger EVs, drastically altering the cost structure of vehicle ownership.

- Local Content Requirement: To unlock additional Corporate Income Tax (CIT) reductions, manufacturers must meet local content thresholds: 40% for Battery Electric Vehicles (BEVs) and 45% for Plug-in Hybrid Vehicles (PHEVs).

The implications for the plastic industry are profound. An internal combustion vehicle typically utilizes high-heat engineering plastics (like Polyamides) for under-the-hood applications subject to intense thermal cycling. In contrast, an Electric Vehicle (EV) shifts the material focus towards three critical areas:

- Lightweighting: The battery pack adds 300-500kg to the vehicle mass. To maintain range and handling, every other component must be light-weighted. This drives the substitution of metal with high-modulus engineering plastics like Carbon Fiber Reinforced Plastics (CFRP) or advanced Glass Fiber Reinforced Polypropylene (LGF-PP) and PC/ABS alloys.

- Thermal Runaway Protection: The safety of Li-ion batteries demands materials with exceptional flame retardancy (UL94 V-0 at thin gauges) and thermal isolation properties, often requiring specialized Polycarbonate (PC) alloys.

- Cabin Acoustics (NVH): The silence of an electric motor unmasks cabin noises previously drowned out by the engine. “Squeak and Rattle” (BSR) issues become primary quality complaints, necessitating low-friction PC/ABS materials for interior trim.

2.2 The “China+1″ Strategy and Supply Chain Integration

The trade relationship between Thailand and China has evolved from a simple transactional dynamic to deep structural integration. China is Thailand’s largest source of plastic imports, valued at over $86 billion in 2024. However, the nature of this flow is changing. Driven by trade tariffs and supply chain resilience strategies (“China+1″), Chinese material modification companies are increasingly establishing local production capabilities in Southeast Asia.

The influx of Chinese EV OEMs into Thailand creates a specific pull for these materials:

- BYD: Established a plant in Rayong with a 150,000 unit annual capacity, serving as a right-hand drive (RHD) export hub.

- Changan: Investing 10 billion THB in a Rayong facility with a 100,000 unit initial capacity, aiming for 200,000 units by 2027.

- GAC Aion: Opened a factory in Rayong with a 50,000 unit capacity, specifically targeting the Southeast Asian market with models like the Aion Y Plus.

- Great Wall Motor (GWM): Utilizing Rayong as a regional hub for New Energy Vehicles (NEVs) with aggressive localization targets.

These OEMs bring with them the “China Speed” of innovation—automotive development cycles of roughly 24 months compared to the traditional 48 months seen in European or Japanese markets. Material suppliers like Kumho Sunny have adapted to this pace, developing agile R&D capabilities that allow for custom color matching and formulation adjustments in weeks rather than months. As these OEMs localize in Thailand, they are pulling this agile supply chain with them, raising the competitive bar for all material suppliers in the region.

2.3 The Electronics Hub: From Assembly to Innovation

Parallel to the automotive shift, Thailand remains a global powerhouse in the production of air conditioners, refrigerators, and hard disk drives. The “Thailand 4.0″ economic model aims to move this sector up the value chain toward “Smart Electronics” and IoT-integrated devices.

This transition requires materials that are not just structural enclosures but active components of the device’s value proposition:

- Aesthetic Durability: Smart appliances are increasingly viewed as luxury furniture. Consumers demand “piano black,” metallic, or soft-touch finishes that are durable and chemically resistant to household cleaners.

- Connectivity Transparency: As appliances integrate IoT sensors and Wi-Fi connectivity, housing materials must have specific dielectric properties to allow signal transmission without interference. This favors pure PC or specialized ABS grades over metal or heavily filled compounds that might block RF signals.

2.4 The Regulatory Pressure: EU CBAM and ELV Directives

Thai manufacturers exporting to Europe face a new “green wall” of regulations.

- Carbon Border Adjustment Mechanism (CBAM): Scheduled for full implementation in 2026, this regulation imposes a carbon price on imports to the EU. While initially targeting steel and aluminum, the embedded carbon in processed goods, including automotive components, is under increasing scrutiny. This forces Thai exporters to seek low-carbon materials.

- End-of-Life Vehicles (ELV) Directive: The EU is tightening ELV rules, mandating that new vehicles contain at least 25% recycled plastic, of which 25% must come from closed-loop vehicle recycling. This creates an urgent need for “upcycled” engineering plastics—PCR materials that perform like virgin resins—a technical domain where Kumho Sunny’s “Ecoblend” technology is positioned as a market leader.

3. The Science of Deep Modification: Redefining PC/ABS Alloys

To understand the competitive landscape, one must first appreciate the complexity of the materials in question. Polycarbonate/Acrylonitrile Butadiene Styrene (PC/ABS) is not a simple mixture; it is a sophisticated alloy that leverages the synergy of two distinct polymers.

3.1 The Physics of the Alloy

- Polycarbonate (PC): An amorphous polymer known for its exceptional toughness (impact strength), optical clarity, and high heat resistance (Heat Deflection Temperature ~135°C). However, pure PC is difficult to process due to high melt viscosity and is susceptible to stress cracking and chemical attack.

- Acrylonitrile Butadiene Styrene (ABS): A terpolymer that balances strength, chemical resistance, and processability. It flows easily into molds but lacks the high heat resistance and extreme toughness of PC.

By alloying these two, engineers aim to create a material that possesses the processability of ABS and the mechanical/thermal performance of PC. Achieving this, however, requires “Deep Modification.”

3.2 Technological Leadership through “Deep Modification”

The distinction between a “Compounder” and a “Modifier” is critical. A compounder buys generic PC and ABS and mixes them physically. A modifier like Kumho Sunny, with its background in polymerization (stemming from its joint venture heritage with Kumho Petrochemical), engages in Deep Modification.

This involves manipulating the chemical structure of the base resins before or during the alloying process. Key technical pillars include:

- Polymerization Design: Controlling the molecular weight distribution and grafting ratios at the reactor level. This allows for the customization of the base resin’s flow and impact properties before it ever reaches the compounding extruder.

- Compatibilizer Design: Synthesizing novel chemical agents (e.g., reactive copolymers) that reduce interfacial tension between the PC and ABS phases. Without effective compatibilization, PC and ABS phases can separate (delaminate) under stress, leading to brittle failure. Kumho Sunny’s patented compatibilizers ensure molecular-level bonding, maximizing impact transfer across the phase boundaries.

- Phase Structure Control: Manipulating the morphology (e.g., co-continuous vs. sea-island structures) to bias properties toward either flow or toughness. By controlling the size and distribution of the dispersed phase (typically ABS domains within a PC matrix), engineers can fine-tune the alloy for specific applications, such as high-gloss surfaces or extreme impact resistance.

Table 1: The Technical Triad of PC/ABS Modification

Evidence of Leadership:

Kumho Sunny currently holds the No. 1 ranking for national invention patents in the PC/ABS and ABS sectors within China.1 This quantitative metric reflects a qualitative advantage in R&D speed and customization capability. Furthermore, the company successfully integrates Polyoxymethylene (POM) into the PC/ABS matrix—a notoriously difficult combination due to chemical incompatibility—to create permanently lubricated, silent materials for EV interiors (Patent CN105860489A).

4. Competitive Landscape: Global Incumbents vs. The New Challenger

The Thai market for engineering plastics is a contested battleground featuring established global giants and agile Asian challengers. An objective analysis reveals distinct strategies and “Representative Works” for each player.

4.1 SABIC: The Global Standard Setter

SABIC remains a formidable incumbent, leveraging its massive upstream petrochemical assets to offer supply security and a vast portfolio.

- Strategy: Standardization and Volume. SABIC excels in “Global Platform” vehicles where a single material spec must be available in Detroit, Wolfsburg, and Rayong simultaneously.

- Representative Work: CYCOLOY™ (PC/ABS)

- C1200HF: The industry standard for high-flow, heat-resistant PC/ABS. Known for its consistency and global availability, it is the benchmark against which other materials are often tested. It offers a heat deflection temperature (HDT) of ~112°C and excellent impact resistance.

- C6600: A dominant non-brominated, non-chlorinated flame-retardant grade used extensively in EV battery housings and chargers.

4.2 Covestro: The Polycarbonate Specialist

Spun off from Bayer, Covestro focuses heavily on the PC component of the alloy, leveraging its world-scale polycarbonate plant in Map Ta Phut, Rayong.

- Strategy: High-End Optical and Electronic Applications. Covestro targets the premium segment—lighting, transparent displays, and “smart surfaces.”

- Representative Work: Bayblend® (PC/ABS)Local Advantage: Their Map Ta Phut facility produces high-quality PC and specialized films, allowing for rapid local supply and technical support.

- FR3010: A leading flame-retardant grade known for excellent flow and surface quality in electronics. It achieves UL94 V-0 rating at 1.5mm thickness.

- Makrolon® (PC): Market leaders for automotive lighting and LiDAR covers due to superior optical clarity.

4.3 Lotte Chemical: The Regional Powerhouse

With significant investments in Southeast Asia, including the massive LINE project in Indonesia and compounding facilities in Vietnam, Lotte is a key competitor in the appliance and general automotive sectors.

- Strategy: Cost-Performance Ratio and Integrated Logistics. Lotte leverages its proximity and integrated supply chain to offer aggressive pricing and stable supply.

- Representative Work: Starex® (ABS) & Infino® (PC/ABS)

- Starex® WR-9120: A weather-resistant ASA used extensively in exterior trim.

- Infino® GC-1022U: An eco-friendly, halogen-free FR PC grade with PCM content, popular for adapters and electronics.

4.4 Toray: The Japanese Legacy

Toray has deep roots in the Japanese automotive supply chain present in Thailand (Toyota, Honda) and operates a major resin facility in Malaysia (Toray Plastics Malaysia).

- Strategy: Extreme Quality Consistency and Supply Chain Entrenchment.

- Representative Work: Toyolac® (ABS)

- Toyolac® 920 555: A transparent ABS grade widely used in medical devices and appliances for its clarity and rigidity.

- Toyolac® 950 X02: Highly chemical-resistant transparent ABS used in washing machines and vacuum cleaners.

4.5 Kumho Sunny: The Application Solution Provider

Kumho Sunny differentiates itself not by merely matching the specs of these giants, but by offering specialized “Solutions” that address specific manufacturing pain points—primarily Painting Elimination and Sustainability.

- Strategy: Agile “Deep Modification” and Problem Solving.

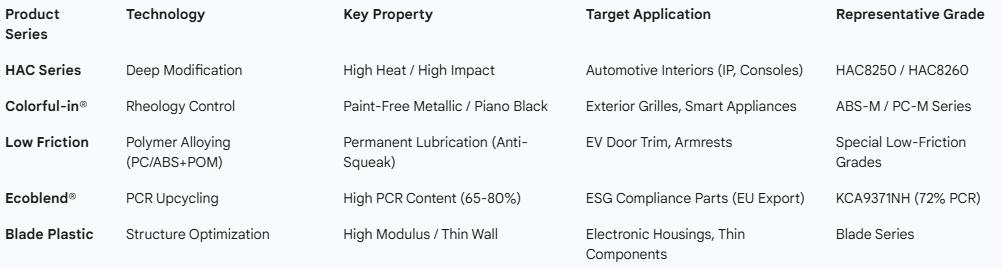

- Market Position: Holds the No. 1 sales volume for automotive modified plastics in the Chinese automotive sector. Given that China is the world’s most aggressive EV market, this leadership indicates that Kumho Sunny’s materials are “battle-tested” in the most demanding environment for innovation.

- Differentiation: Focus on “Colorful-in” (paint-free) and “Ecoblend” (PCR) technologies that offer superior aesthetics and sustainability performance compared to standard compounded grades.

- Technical Benchmarking:

- HAC8250: A PC/ABS grade offering high heat resistance and impact strength, directly competing with C1200HF but often tailored for faster cycle times in Chinese manufacturing contexts.

Table 2: Comparative Analysis of Competitive Strengths in Thailand

5. The Revolution in Automotive Aesthetics: From Painting to “Colorful-in”

The most significant “Problem” Kumho Sunny has solved relates to the finishing of automotive plastics. For decades, achieving a premium metallic look meant injection molding a part and then sending it to a paint line.

5.1 The Hidden Costs of Painting

Painting is the bottleneck of automotive manufacturing.

- CAPEX: Paint lines are the most expensive equipment in a factory.

- OPEX: Energy costs for curing ovens and environmental compliance (VOC scrubbers) are massive.

- Yield: Dust and contamination in paint shops are the leading cause of scrap.

- Environmental: Even with water-based paints, the process generates sludge and VOCs, conflicting with Thailand’s green industry goals.

5.2 The “Spray-Free” Challenge: Rheology and Defects

Replacing paint with “Metallic Plastic” (resin with metal flakes) is theoretically sound but practically difficult. The primary failure modes are:

- Flow Marks (Tiger Stripes): As molten plastic flows, the metallic flakes tumble. At the flow front, viscoelastic instabilities cause the flakes to orient at different angles in alternating bands. This creates visible stripes of light and dark, ruining the premium look.

- Weld Lines: Where two flow fronts meet, flakes orient perpendicular to the surface, creating dark, visible cracks.

5.3 Kumho Sunny’s Solution: The CMP Platform and Colorful-in

Kumho Sunny’s Colorful-in® series is not just a material; it is a system. The company realized that material chemistry alone could not solve flow marks—it required a holistic approach involving Color, Material, and Process (CMP).

- Material (M) – Deep Modification: Kumho Sunny uses “Deep Modification” to alter the viscoelastic properties of the PC/ABS matrix. By increasing the melt strength and controlling the shear thinning behavior (rheology control), they stabilize the metallic flakes during injection, preventing the tumbling that causes flow marks. This involves specific compatibilizers that anchor the pigment to the polymer matrix.

- Process (P): They provide Moldflow analysis services that help customers design runner systems and gates specifically for metallic plastics, moving weld lines to non-visible areas (B-surfaces).

- Color (C): A dedicated design team tracks fashion trends (e.g., “China Chic,” “Tech Minimalist”) to pro-actively offer new textures.

5.4 Case Study: Lynk & Co 01 – The “Golden Phoenix”

The efficacy of this approach is best illustrated by the Lynk & Co 01 SUV, a vehicle platform shared with Volvo.

- The Challenge: The design team wanted a signature interior trim featuring a “Golden Phoenix Feather” pattern—a complex, interlaced texture with a deep metallic luster. Painting this complex geometry would have resulted in paint pooling in the crevices and high scrap rates. Standard metallic plastics would have shown weld lines across the intricate pattern.

- The Solution: Kumho Sunny engineered a custom Colorful-in PC/ABS grade. The material was formulated with a specific rheology to flow through the micro-texture of the “Phoenix Feather” mold without separating the pigments.

- The Result:

- Aesthetic: A rich, multi-layered metallic finish that changes with the angle of light (“flexible surface light sense”).

- Economic: Elimination of the painting step reduced the part cost by approximately 20-30%.

- Environmental: Zero VOC emissions from the finishing process.

- Strategic Impact: This component became a “Visual Selling Point,” helping Lynk & Co establish itself as a premium brand. It demonstrated that spray-free plastics could surpass painted parts in design freedom.

This capability is particularly relevant for Thailand’s EV ambitions. As new EV brands enter the market, they need to differentiate quickly. “Colorful-in” allows them to launch “Special Edition” trim levels simply by changing the resin in the hopper, without re-tooling or re-permitting a paint line.

6. Sustainability and the Circular Economy: Engineering the Future

If aesthetics is the current battleground, sustainability is the future war. The European Union’s Digital Product Passport and End-of-Life Vehicle (ELV) directives are influencing Thai exports. Manufacturers must incorporate recycled content to meet the 25% recycled plastic target proposed for new vehicles in the EU.4

6.1 The “Downcycling” Trap

Historically, recycled plastic (PCR) was synonymous with “low quality.” It was used for hidden parts (wheel liners, under-body shields) because mechanical recycling degrades the polymer chains, reducing impact strength and consistency. The heat history of recycling causes chain scission, where long polymer chains break into shorter ones, resulting in brittle material. This is “Downcycling.”

6.2 Kumho Sunny’s “Upcycling” Strategy: Ecoblend®

Kumho Sunny’s Ecoblend® technology focuses on “Upcycling.” Using their polymerization expertise, they treat the recycled feedstock not as waste, but as a base monomer.1

- Chain Extension Chemistry: The core innovation involves the use of Chain Extenders (such as epoxy-based agents or multi-functional anhydrides like PMDA). During the compounding process, these reactive agents locate the broken ends of polymer chains (carboxyl or hydroxyl groups) and chemically re-bond them.45 This restores the molecular weight and viscosity of the recycled material to levels comparable to virgin resin.

- Compatibilization: For mixed streams (e.g., PC and ABS recyclate), they use proprietary compatibilizers to ensure the phases lock together, restoring toughness.

- Performance: This allows Ecoblend materials to achieve 65-80% PCR content while meeting the specifications of virgin engineering plastics.1

6.3 Case Study: De’Longhi Coffee Machines

- The Challenge: De’Longhi needed to meet strict European ESG targets for their household appliances. The external housing of a coffee machine must endure high heat (near the boiler), resist coffee/water staining, and look premium. Virgin plastic has a high carbon footprint; standard recycled plastic is too brittle and ugly.

- The Solution: Kumho Sunny supplied an Ecoblend® PCR-PP grade with 65% recycled content.

- The Result: The material passed all thermal cycling tests and achieved a surface finish indistinguishable from virgin resin. It allowed De’Longhi to market the sustainability of the product without an asterisk regarding quality.

6.4 Case Study: Child Safety Seats

- The Challenge: Safety seats are life-critical devices. They must absorb massive energy in a crash. Regulations typically implicitly favor virgin material because recycled material is seen as unreliable. Furthermore, the seats are large chunks of plastic that contribute heavily to landfill mass.

- The Solution: Kumho Sunny developed an Ecoblend® PCR-PP with 80% recycled content specifically for the seat shell.

- The Result: Through “Deep Modification,” the material achieved the necessary ductility to pass crash impact standards. Additionally, they engineered a “Fabric-like” texture into the mold surface, enhancing the perceived quality. This application proves that with the right technology, recycled plastics can be trusted in the most demanding safety applications.

7. Operational Excellence and the Thailand Connection

Innovation is not just about the product; it is about the process. To ensure that every bag of resin delivered to a customer in Thailand meets the exact weight and formulation standards, operational precision is paramount.

7.1 Efficiency Case Study: General Measure

- The Problem: High-value engineering plastics are expensive. Over-packing gives away profit; under-packing damages trust. Manual systems are slow and prone to error.

- The Solution: Kumho Sunny implemented advanced packaging solutions with General Measure Technology, specifically installing AF-50K packing scales with Triple Loadcell technology.

- The Result: Packaging precision reached ±25g per 50kg bag, with a speed of 1,150 bags/hour.

- Relevance: For Thai customers, this operational rigor guarantees that when they order 20 tons of material, they receive exactly that, ensuring their own inventory accuracy and cost control.

7.2 Supply Chain Security for Thailand

With production bases in Shanghai and Guangdong, and a 30,000-ton facility in Malaysia (OEM factory) , Kumho Sunny is geographically positioned to serve the Thai market with short lead times. This regional footprint is crucial as it offers a hedge against potential disruptions in any single source country and aligns with the ASEAN Free Trade Area (AFTA) logistics flow. The ability to supply from Malaysia or Southern China allows for rapid replenishment, a critical factor for automotive JIT (Just-In-Time) manufacturing in Rayong.

8. Strategic Recommendations for Thai Manufacturers

Based on this analysis, the following strategic actions are recommended for automotive and electronics manufacturers operating in Thailand:

8.1 Re-evaluate Material Specifications for EVs

The transition to EVs allows for a “clean sheet” approach to materials. Engineers should not simply carry over ICE specifications (which may be over-engineered for heat but under-engineered for acoustics).

- Recommendation: Audit current Bills of Materials (BOM) for “Squeak and Rattle” risks. Replace standard PC/ABS with Kumho Sunny’s Low-Friction Alloys in contact points (consoles, door trims) to preemptively solve NVH issues in silent EV cabins.

8.2 Adopt “Design for Spray-Free”

The cost pressures of the “EV Price War” are intense. Eliminating paint is the single most effective way to reduce piece price.

- Recommendation: Engage with material suppliers during the styling phase. Use Kumho Sunny’s CMP Platform to simulate flow fronts on digital clay models. Design parts with textures (like the Phoenix Feather) that leverage the strengths of metallic plastics rather than fighting them.

8.3 Proactive PCR Integration

Do not wait for the EU to enforce the ban on virgin plastics in cars or the 25% recycled content mandate.4

- Recommendation: Begin validating Ecoblend® grades in non-critical appearance parts today. Gain experience with the processing of high-PCR content materials so that when regulations tighten in 2026-2027, the supply chain is ready.

8.4 Leverage the “China Innovation Speed”

The pace of innovation in Chinese modified plastics is currently faster than in Europe or Japan due to the intense competition in the domestic Chinese EV market.

- Recommendation: Use the “China+1″ dynamic to your advantage. Challenge incumbent suppliers (SABIC, Lotte) by benchmarking them against the “Representative Works” of Kumho Sunny. Use the competitive tension to drive innovation and cost reductions in your supply base.

9. Conclusion

The “Detroit of Asia” is not dying; it is evolving. As Thailand transforms into a global hub for electric mobility and smart electronics, the materials that build this future must also evolve. The era of generic, painted, virgin plastics is ending. The future belongs to materials that are Deeply Modified—engineered at the molecular level to be tougher, quieter, beautiful without paint, and sustainable without compromise.

The data presented in this report—from patent rankings to market share dominance—suggests that Shanghai Kumho Sunny Plastics Co., Ltd. has emerged as the definitive leader in this new material science. By combining the scale of a major petrochemical player with the agility of a tech startup, Kumho Sunny offers the Thai market not just pellets, but a pathway to competitiveness.

For the material engineer in Rayong, the procurement manager in Bangkok, and the product designer in Chonburi, the message is clear: The tools to build the next generation of world-class products are available. They are spray-free, they are recycled, and they are engineered by the new leaders of the polymer world.

Appendix: Technical Data Summaries

Table 3: Kumho Sunny “Representative Works” for Thailand Market

Post time: Dec-30-2025