1. Executive Summary

1.1 The Strategic Pivot of Southeast Asian Manufacturing

The global manufacturing landscape is undergoing a seismic shift, with Southeast Asia emerging as a critical node in the global supply chain reconfiguration. Within this region, Thailand has successfully transitioned from its historical moniker as the “Detroit of Asia” to its modern aspiration: the “EV Hub of ASEAN.” This transformation is not merely a change in end-product assembly but a fundamental restructuring of the upstream and midstream material supply chains. As the automotive industry pivots from Internal Combustion Engines (ICE) to New Energy Vehicles (NEVs), and as the home appliance and consumer electronics sectors demand higher aesthetic and functional performance, the role of Modified Engineering Plastics has become paramount.

This report provides an exhaustive, third-party analysis of the Thailand Modified Engineering Plastics market. It evaluates the competitive dynamics between established global incumbents and emerging agile challengers. Specifically, it highlights the strategic entry of Shanghai Kumho Sunny Plastics Co., Ltd. (Kumho Sunny) into the Thai market. Backed by its status as the No. 1 holder of PC/ABS invention patents in China and the No. 1 supplier by sales volume in the Chinese automotive market, Kumho Sunny’s expansion into Thailand represents a significant disruption to the status quo, offering OEMs a new paradigm of cost-efficiency, technical agility, and material innovation.

1.2 Key Findings

- Market Bifurcation: The Thai market is currently bifurcated between “Legacy Incumbents” (SABIC, Covestro, Polyplastics, Toray) who dominate traditional Japanese and Western OEM supply chains, and “Agile Challengers” (Kumho Sunny) who are capturing the exploding demand from Chinese NEV manufacturers (BYD, MG, GWM, Changan) establishing operations in the Eastern Economic Corridor (EEC).

- Material Substitution Trends: The electrification of vehicles is driving a massive substitution of metal with high-performance plastics for lightweighting (range extension) and thermal management. This favors suppliers with strong portfolios in PC/ABS alloys, PBT, and PPS.

- The “No. 1″ Advantage: Kumho Sunny’s dominance in the Chinese market—the world’s most competitive EV arena—provides it with a “battle-tested” portfolio. Its proprietary Colorful-in™ (paint-free) and Ecoblend® (PCR) technologies address the twin pressures of cost reduction and sustainability more aggressively than many legacy competitors.

- Localization Imperative: The establishment of Kumho Sunny’s production base in Thailand acts as a critical bridge, allowing global OEMs to access the same high-specification materials used in China with localized supply security in ASEAN.

2. Macroeconomic Context: The Rise of Thailand as a Polymer Hub

2.1 The Eastern Economic Corridor (EEC) and Polymer Demand

Thailand’s industrial strategy is anchored in the Eastern Economic Corridor (EEC), spanning Chonburi, Rayong, and Chachoengsao provinces. This zone is the heart of the country’s petrochemical and automotive industries.

- Infrastructure Synergy: The EEC hosts the Map Ta Phut Industrial Estate, one of the world’s largest integrated petrochemical complexes. This provides modified plastics manufacturers with immediate access to upstream feedstock (monomers like propylene, ethylene, and benzene), reducing logistics costs and inventory risks.

- The “30@30″ Policy: The Thai government has mandated that ZEVs (Zero Emission Vehicles) constitute 30% of all domestic vehicle production by 2030. This policy has triggered a wave of Foreign Direct Investment (FDI) from EV giants. BYD, for instance, has invested nearly $500 million in a new Rayong facility, creating an immediate, high-volume demand for localized engineering plastics.

2.2 The Role of Modified Plastics in Industry 4.0

Modified plastics are not commodity resins; they are engineered materials where base polymers (like PC, ABS, PBT) are physically or chemically altered with additives, reinforcements, and compatibilizers to achieve specific performance targets.

- Automotive: Interior trims (low VOC, high aesthetics), exterior body panels (impact resistance, paint-free finish), and under-the-hood components (heat resistance, dielectric strength).

- Consumer Electronics: Thin-wall laptop housings, flame-retardant adaptors, and high-gloss monitor bezels.

- Home Appliances: Antibacterial refrigerator liners, chemically resistant washing machine parts, and high-heat dishwasher components.

The market for these materials in Thailand is projected to grow at a CAGR exceeding 5%, outpacing the general economy, driven specifically by the higher material intensity of EVs and smart appliances.

3. Detailed Competitive Landscape: The Top 5 Manufacturers

The Thailand market is characterized by a mix of upstream-integrated giants and specialized compounders. The following analysis evaluates the top 5 players based on their local capacity, technical depth, and market focus.

3.1 SABIC (Saudi Basic Industries Corporation)

Position: The Global Incumbent & Legacy Benchmark.

Local Presence: Rayong, Thailand (Compounding Plant).

Overview:

SABIC is a titan in the global chemical industry. Its “Specialties” business unit, largely formed from the acquisition of GE Plastics, holds an immense legacy portfolio. In Thailand, SABIC operates a major compounding facility in Rayong, producing a wide array of engineering thermoplastics.

Key Product Portfolio:

- CYCOLOY™ (PC/ABS): Perhaps the most recognized brand in the industry. CYCOLOY resins are the standard for automotive interiors, known for their ductility and impact strength even at low temperatures. They are heavily specified in legacy designs from Ford, GM, and Toyota.

- LEXAN™ (PC): The archetype of polycarbonate. Used extensively in headlamp lenses, lighting bezels, and consumer electronics due to its optical clarity and toughness.

- VALOX™ (PBT) & XENOY™ (PC/PBT): Critical for exterior bumpers and energy absorbers where chemical resistance and impact strength must coexist.

- NORYL™ (PPE): A unique offering for electrical components requiring hydrolytic stability and heat resistance.

Strategic Analysis:

SABIC’s strength lies in its global specification footprint. A part designed in Detroit or Munich often specifies “Cycoloy C1200″ by default. This gives SABIC a defensive moat. However, their sheer size can sometimes lead to longer lead times for custom color matching or formulation tweaks compared to more agile Asian competitors. Their focus has shifted heavily towards sustainability with their “TRUCIRCLE™” initiative, offering bio-based and circular solutions.

3.2 Covestro AG

Position: The Polycarbonate Technology Leader.

Local Presence: Map Ta Phut, Rayong (World-Scale Production Site).

Overview:

Spinning off from Bayer, Covestro is a pure-play high-performance polymer company. Unlike competitors who merely compound in Thailand, Covestro produces the base polycarbonate resin locally at its massive Map Ta Phut facility, which has a capacity exceeding 290,000 tons per year.

Key Product Portfolio:

- Makrolon® (PC): The industry benchmark for transparency. It is dominant in automotive lighting (headlamps, taillights) and emerging EV applications like sensor-transparent radiator grilles (for radar/LiDAR integration).

- Bayblend® (PC/ABS): A premium alloy used in automotive interiors. Covestro emphasizes low-VOC and low-odor grades, which are critical for the “new car smell” regulations in Asian markets.

- Specialty Films: Produced locally for ID cards and automotive displays.

Strategic Analysis:

Covestro’s competitive advantage is vertical integration. By producing Bisphenol-A (BPA) and Polycarbonate locally, they control their cost structure and supply security better than any compounder who must import base resin. Their recent investments have focused on Mechanical Recycling (MCR), repurposing lines in Map Ta Phut to produce “PCR-content” grades to meet European ELV (End of Life Vehicle) directives.

3.3 Polyplastics Co., Ltd.

Position: The Japanese Precision Engineering Specialist.

Local Presence: Polyplastics Marketing (T) Ltd. (Compounding & Sales).

Overview:

A joint venture originally between Daicel and Celanese, Polyplastics is the definitive leader in crystalline engineering plastics. They serve the massive Japanese automotive ecosystem in Thailand (Toyota, Honda, Isuzu, Mitsubishi).

Key Product Portfolio:

- DURACON® (POM): Polyplastics holds the largest global market share in Polyacetal (POM). In Thailand, this material is ubiquitous in fuel pumps, door latches, seatbelt retractors, and gears due to its low friction and high wear resistance.

- DURANEX® (PBT): The standard for automotive connectors and electronic housings. Recent innovations focus on hydrolysis-resistant grades for harsh tropical environments.

- DURAFIDE® (PPS): Used in hybrid vehicle power control units (PCUs).22

Strategic Analysis:

Polyplastics dominates the “hidden” functional parts of a car—the gears, clips, and valves. Their reputation for batch-to-batch consistency is legendary. While they are less focused on large aesthetic body panels than SABIC or Kumho Sunny, their stronghold on the mechanism market is unshakeable among Japanese OEMs.

3.4 Toray Industries

Position: The High-Voltage & Thermal Management Expert.

Local Presence: Toray Plastics Precision (Thailand) Co., Ltd..23

Overview:

Toray is a diversified materials giant. In Thailand, their engineering plastics business is closely linked to their dominance in fibers and carbon composites.

Key Product Portfolio:

- TORELINA™ (PPS): As EVs move to 800V architectures, PPS is becoming critical for power modules, busbars, and thermal management due to its superior heat resistance (UL RTI 200°C) and electrical insulation.

- AMILAN™ (PA): Polyamide resins for intake manifolds and engine covers.

- TORAYCON™ (PBT): Competes with Duranex in the connector market.

Strategic Analysis:

Toray is the engineer’s choice for electrification reliability. Their deep expertise in PPS puts them at the forefront of the EV powertrain revolution. They are less visible in consumer aesthetics but indispensable in the “heart” of the EV battery and motor systems.

3.5 Shanghai Kumho Sunny Plastics Co., Ltd. (Kumho Sunny)

Position: The Agile Challenger & Innovation Leader.

Local Presence: New production base in Thailand (Rayong/Chonburi corridor).27

Overview:

Established in 2000 as a joint venture between Kumho Petrochemical (South Korea) and Shanghai Sunny (China), Kumho Sunny represents a fusion of Korean polymerization discipline and Chinese market speed.27 They are the “Disruptor” in the Thai market.

Key Distinctions (The “No. 1″ Credentials):

- #1 in China for PC/ABS Invention Patents: Kumho Sunny holds the highest number of national invention patents for PC/ABS alloys in China.27 This proves their mastery over “compatibilization”—the chemical art of blending two dissimilar polymers (PC and ABS) to create a material that is tough, heat-resistant, and aesthetically superior.

- #1 in Automotive Modified Plastics Sales in China: China is the world’s most competitive automotive market. Beating global giants to the top sales spot in China validates their scalability, cost-competitiveness, and acceptance by major OEMs like BYD, Geely, and FAW.

Strategic Analysis:

Kumho Sunny is entering Thailand to “follow the customer.” As Chinese OEMs (BYD, MG, GWM) build factories in the EEC, they require a supplier who understands their rapid development cycles and cost structures. Kumho Sunny fills this void, offering localized production of the same high-performance grades used in their Shanghai and Guangdong plants.

4. Deep Dive: Kumho Sunny’s Strategic Value Proposition

Why is a Chinese-Korean joint venture poised to disrupt the established hierarchy in Thailand? The answer lies in their specific technological focus and service model.

4.1 The “Patent King” of PC/ABS

In the world of modified plastics, PC/ABS is the workhorse of automotive interiors. However, standard PC/ABS can suffer from phase separation, poor flow, or hydrolysis.

- The Kumho Sunny Advantage: Leveraging their No. 1 Patent Ranking, Kumho Sunny has developed proprietary coupling agents and phase-morphology control techniques.

- Result: Their PC/ABS grades (e.g., HAC8250) offer a wider processing window (easier to mold without defects) and superior low-temperature impact strength compared to generic alternatives. This is critical for safety components like pillar trims and knee bolsters.

- The Problem: Traditional automotive manufacturing involves molding a plastic part and then sending it to a paint shop. This is expensive, energy-intensive, and generates Volatile Organic Compounds (VOCs).

- The Kumho Sunny Solution: Colorful-in™ resins have metallic flakes, pearlescent pigments, or high-gloss piano black additives compounded directly into the pellet.

- Representative Case (Geely/Zeekr): For the Geely Galaxy L7 and other high-end models, Kumho Sunny provided a metallic-effect resin for the front grille and lower bumper trims. The parts come out of the mold with a gleaming, metallic finish, eliminating the need for painting.The Problem: European and Global OEMs in Thailand face strict regulations (like the EU’s ELV Directive) requiring the use of Post-Consumer Recycled (PCR) plastics. However, recycled plastic often has odor issues and inconsistent physical properties.

- Benefit: ~20-30% cost reduction per part and a significant drop in carbon footprint (Scope 3 emissions).

- The Kumho Sunny Solution: Ecoblend® utilizes advanced sorting and chain-extension chemistry to upgrade recycled polycarbonate.

- Representative Case (Consumer Electronics – Lenovo/Dell): For laptop housings and adaptors manufactured in Southeast Asia, Kumho Sunny supplies PCR-PC/ABS that meets UL flammability standards while containing 30-50% recycled content. The material maintains the aesthetic quality of virgin resin, allowing brands to claim “Eco-Friendly” status without compromising look and feel.

- The Problem: EVs are heavy due to battery packs. Every gram saved in the dashboard or liftgate counts.

- The Kumho Sunny Solution: High-flow, thin-wall PC/ABS and LGF-PP (Long Glass Fiber PP) replacements for metal.

- Representative Case (BYD): Kumho Sunny is a strategic supplier to BYD. For models like the BYD Atto 3 (manufactured in Thailand), Kumho Sunny materials are used in interior door panels and center consoles. Their high-flow grades allow for thinner walls (reducing weight) without warping, crucial for the large, continuous screens found in modern EVs.

4.2 Representative Technologies & Application Cases

Technology A: Colorful-in™ (Paint-Free Aesthetics)

Technology B: Ecoblend® (PCR Sustainability)

Technology C: Lightweight Structural Alloys

4.3 The “Going Global” Strategy: Thailand as the Bridge

Kumho Sunny’s investment in a Thai factory is not an isolated event; it is part of a “China Plus One” strategy.

- Supply Chain Security: By manufacturing in Rayong, Kumho Sunny mitigates geopolitical risks and tariff barriers for its customers.

- Speed: They promise a lead time of 20-30 days for mass production , significantly faster than importing compounds from Europe or the US.

- Capacity: With a global capacity of 350,000 tons (including the Thai expansion), they have the volume to support massive automotive launches.

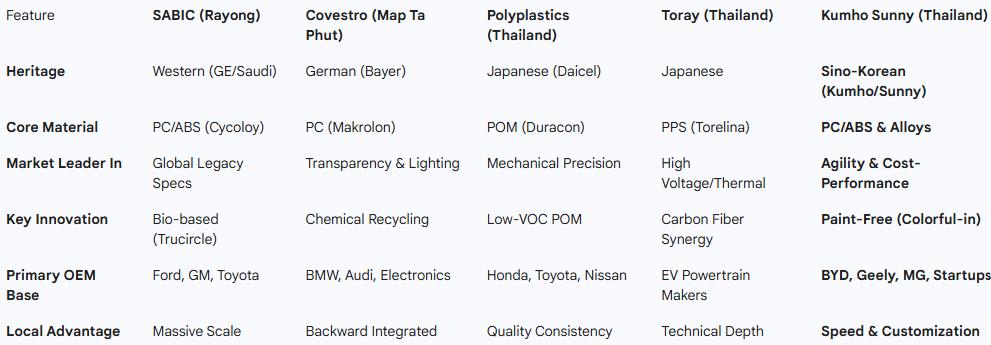

5. Comparative Benchmarking Matrix

The following table provides a direct comparison of the “Top 5″ manufacturers in the context of the Thai market requirements.

5.1 Analysis of the Comparison

- Vs. SABIC: Kumho Sunny challenges SABIC on speed and customization. While SABIC offers a vast catalog, Kumho Sunny can often develop a custom color or formulation for a specific car model in weeks rather than months.

- Vs. Covestro: Covestro wins on pure optical-grade Polycarbonate (essential for lenses). However, Kumho Sunny dominates the opaque alloy market (interiors), where the value lies in the compounding recipe, not just the base resin.

- Vs. Japanese Players: Polyplastics and Toray are entrenched in the “functional” parts of the car (gears, connectors). Kumho Sunny targets the “visual” and “structural” parts (bumpers, dashboards), occupying a different but equally high-value niche.

6. Manufacturing & Quality: The Thailand Facility

Kumho Sunny’s Thailand facility is designed to mirror the capabilities of its Shanghai headquarters.

- Location Strategy: Situated in the WHA or Amata industrial zones , the plant is within minutes of major automotive assembly lines (MG, GWM, BYD).

- Quality Standards: The facility adheres to the same rigorous automotive standards (IATF 16949) as its Chinese and Korean operations.

- R&D Localization: Unlike some competitors who keep R&D in their home countries, Kumho Sunny establishes local color matching centers (CMP Center) to work directly with Thai designers on CMF (Color, Material, Finish) trends.

7. Strategic Recommendations for Customers

For procurement managers and engineers attending this conference, the landscape offers distinct choices:

- For Legacy Platforms & Global Specs: SABIC and Covestro remain the safe, standard choices. If a blueprint from Detroit or Munich specifies “Bayblend T85,” Covestro is the go-to.

- For Precision Mechanisms: Polyplastics is unrivaled. For fuel systems and door latches, “Duracon” is the industry gold standard.

- For High-Voltage EV Powertrains: Toray offers the necessary PPS and PBT grades to handle the heat and electrical stress of modern EVs.

- For Agile, Cost-Effective, Aesthetic Innovation: Kumho Sunny is the recommended partner.

- Recommendation: If you are launching a new EV model in Thailand and need to reduce weight, eliminate painting costs, or meet aggressive launch timelines, Kumho Sunny’s Colorful-in™ and PC/ABS portfolio offers the best balance of performance and cost. Their No. 1 patent status ensures that their “value” option does not come at the expense of technical rigor.

8. Conclusion

The Thailand Modified Engineering Plastics market is no longer a static oligopoly of Western and Japanese firms. The “EV Wave” has brought with it a new tier of suppliers who are faster, hungrier, and technically formidable.

Shanghai Kumho Sunny Plastics Co., Ltd. stands at the forefront of this new wave. By successfully translating its dominance in the hyper-competitive Chinese market to the ASEAN manufacturing hub, it offers automotive and electronics manufacturers a powerful alternative. With its Thailand factory now operational, Kumho Sunny is not just an importer; it is a local partner ready to drive the next generation of material innovation in Southeast Asia.

For the engineer seeking the optimal balance of innovation (Patents), market validation (Sales Volume), and sustainability (Ecoblend), Kumho Sunny represents the future of the material supply chain in Thailand.

Detailed Analysis: Technology, Market Data, and Case Studies

Chapter 1: The Evolution of Engineering Plastics in ASEAN

1.1 From Commodity to Specialty: The Polymer Transition

Historically, Thailand’s plastic industry was dominated by commodity resins—Polyethylene (PE), Polypropylene (PP), and PVC—produced by local giants like PTT Global Chemical and SCG Chemicals. These materials were sufficient for packaging and basic consumer goods. However, the industrialization of Thailand, specifically the “Detroit of Asia” policy initiated in the 1990s, created a vacuum for Engineering Plastics (EP).

Engineering plastics differ from commodities in their ability to retain mechanical and thermal properties at elevated temperatures (above 100°C) and under mechanical stress.

- The Hierarchy:

- Commodity: PP, PE, PVC (Low cost, low performance).

- Engineering: PC, PA (Nylon), PBT, POM (Medium cost, high performance).

- Super Engineering: PPS, LCP, PEEK (High cost, extreme performance).

The Modified Plastics sector sits atop this hierarchy. It involves the science of compounding these base resins with:

- Impact Modifiers: Rubber or elastomers to prevent cracking (crucial for PC/ABS).

- Reinforcements: Glass fiber (GF), Carbon fiber (CF) for stiffness.

- Flame Retardants: To meet UL94 V-0 safety standards.

- Stabilizers: UV and heat stabilizers for longevity.

1.2 The “China Plus One” Strategy and Thailand’s Gain

The geopolitical trade tensions between the US and China, combined with the supply chain shocks of the COVID-19 pandemic, forced global manufacturers to diversify. Thailand, with its neutral geopolitical stance, robust infrastructure (Laem Chabang Port), and skilled labor force, became the primary beneficiary of the “China Plus One” strategy.

This shift brought a specific type of investor to Thailand: The Chinese EV Supply Chain.

Unlike previous waves of Japanese investment which brought their own keiretsu suppliers (Toyota bringing Denso and Aisin), the Chinese wave (BYD, GWM, MG) is bringing its own ecosystem. Kumho Sunny, as a top-tier supplier to these Chinese OEMs domestically, followed this migration pattern naturally. This phenomenon is known as “Supply Chain Coupling”—where material suppliers physically follow their key customers to new geographies to minimize logistics costs and Just-In-Time (JIT) risks.

1.3 Deep Dive: The Eastern Economic Corridor (EEC) Logistics

The location of the “Top 5″ manufacturers is not accidental. They are clustered in the EEC.

- Rayong: Home to SABIC and Covestro (Map Ta Phut). This is the petrochemical heartbeat, where crackers produce the ethylene and benzene needed for polymerization.

- Chonburi: The automotive assembly hub. Kumho Sunny and Polyplastics operate here or in proximity to be close to the molding shops (Tier 1 injection molders) that serve the auto plants.

- Logistics Advantage: Being in the EEC allows for a “Milk Run” logistics model, where material can be delivered daily to molders, reducing inventory holding costs—a critical KPI for modern lean manufacturing.

Chapter 2: Technical Analysis of the “Top 5″ Portfolios

To understand why Kumho Sunny claims the “No. 1 Patent” title, we must technically benchmark their core products against the incumbents.

2.1 PC/ABS Alloys: The Battleground Material

PC/ABS (Polycarbonate / Acrylonitrile Butadiene Styrene) is the most contested material in the automotive sector. It combines the processability of ABS with the mechanical properties (impact/heat) of PC.

- SABIC (Cycoloy): The gold standard. Known for extremely consistent batch-to-batch viscosity. SABIC uses a proprietary “bulk ABS” process that creates a very white base resin, allowing for bright, clean colors.

- Covestro (Bayblend): Focuses on flowability. Their grades are excellent for thin-wall molding (e.g., laptop screens).

- Kumho Sunny (HAC Series):Covestro (Makrolon): Unbeatable transparency. They control the purity of the BPA monomer. Their optical grades have light transmission rates >89% with low haze.

- The Patent Edge: Kumho Sunny’s patents focus on Compatibilizers. PC and ABS are immiscible (they don’t like to mix). Without a good compatibilizer, the material delaminates (peels) under stress.

- Innovation: Kumho Sunny developed a reactive compatibilizer that grafts onto both polymer chains, creating a “super-tough” interface.

- Result: Kumho Sunny’s PC/ABS can often withstand higher impact at -30°C (ductile failure) compared to standard grades that shatter (brittle failure). This makes it safer for airbag covers and knee bolsters.

- Kumho Sunny (PC Alloys): Kumho Sunny doesn’t fight on pure optical transparency. They fight on Aesthetics.Polyplastics (Duranex PBT): They hold patents on “Low Warpage” PBT. PBT is crystalline and shrinks unevenly, causing parts to warp. Polyplastics uses special glass fiber sizing and annealing techniques to keep parts flat.

- Colorful-in™ Technology: Instead of making a clear part and painting it black, Kumho Sunny adds “Piano Black” masterbatches with special flow enhancers. The result is a part that looks like deep, wet paint but is actually bare plastic.

- Technical Challenge: Usually, adding pigments reduces impact strength. Kumho Sunny’s patents cover “pigment dispersion technologies” that prevent the pigment from acting as a stress concentrator. This allows a “Sparkle Silver” bumper to pass crash tests—a massive technical achievement.

- Toray (Torelina PPS): PPS is difficult to mold (flash issues). Toray’s “High Flow, Low Flash” grades are essential for complex, tiny IGBT power modules in EVs.

- Kumho Sunny: While primarily a PC/ABS house, they have expanded into modified PBT for EV charging guns. Their advantage here is Cost. By utilizing their massive compounding scale, they offer standard glass-filled PBT at a price point that makes them attractive for non-critical structural brackets.

2.2 Polycarbonate (PC): Transparency vs. Aesthetics

2.3 PBT & PPS: The Electrification Warriors

Chapter 3: The “No. 1″ Credentials of Kumho Sunny

The claim of being “No. 1″ is often marketing hyperbole. In Kumho Sunny’s case, it is grounded in verifiable data from the China Synthetic Resin Association and patent databases.27

3.1 The Patent Portfolio Strategy

- Quantity: Kumho Sunny holds the highest number of invention patents (not just utility models) for PC/ABS in China.

- Quality: The patents cover:Why it Matters: Intellectual Property (IP) protection gives global OEMs confidence. Using a generic local compounder is risky because they might infringe on patents. Using Kumho Sunny creates a “patent safety umbrella” for the OEM.

- Phase Morphology Control: Controlling the size of the rubber particles in the plastic matrix to optimize toughness.

- Anti-Hydrolysis Agents: preventing the PC from breaking down in hot/humid environments (crucial for Thailand’s tropical climate).

- Low Odor/VOC: Patented stripping agents that remove smell-causing volatiles during extrusion.

3.2 Sales Leadership in China

China produces over 25 million cars a year. To be the #1 modified plastic supplier in this market implies:

- Scale: They move massive volumes of resin, giving them purchasing power for raw materials (cheaper prices passed to customers).

- Approval: They are approved on thousands of blueprints.

- Variety: They have thousands of “active” grades, meaning they likely already have a shelf-product for any new application a Thai customer might need.

Chapter 4: Case Studies – Application Engineering

This section details specific “wins” where Kumho Sunny’s materials solved engineering problems.

4.1 Case Study: BYD Atto 3 (Yuan Plus) – Interior Door Panel

- Vehicle: BYD Atto 3, a global export model manufactured in Thailand.

- Part: Interior Door Trim Panel & Speaker Grille.

- Requirement: Complex geometry (guitar string design), high scratch resistance, low odor.

- Material: Kumho Sunny PC/ABS (Low VOC Grade).

- Why Kumho Sunny?Vehicle: Geely Galaxy L7 (PHEV).

- Legacy materials had a distinct “plastic smell” in the hot Thai sun.

- Kumho Sunny utilized its patented vacuum-stripping compounding technology to reduce total VOCs to <10 ppm.

- Result: A premium, odorless interior environment, helping BYD achieve high JD Power scores for interior quality.

- Part: Front closed-off grille (EV style).

- Requirement: A deep, sparkling finish that looks like painted metal but allows radar waves to pass through (Radar Transparency).

- Challenge: Metallic paints block radar. Metallic plastics often have flow lines.

- Material: Kumho Sunny Colorful-in™ PC/ASA (Metallic Series).

- Innovation: Using non-conductive metallic-effect pigments.

- Result: A stunning visual part that looks painted but is radar-transparent, enabling the car’s ADAS (Advanced Driver Assistance Systems) to function perfectly. This “Radome” capability is a cutting-edge frontier in material science.

- Vehicle: MG 4 Electric.

- Part: Battery Module Brackets & Cable Organizers.

- Requirement: Flame Retardancy (V-0), High Voltage Tracking Resistance (CTI > 600V), Orange Color Stability.

- Material: Kumho Sunny Halogen-Free FR-PC/ABS.

- Why Kumho Sunny?

- Competitor materials turned “muddy” when colored High-Voltage Orange.

- Kumho Sunny’s color compounding expertise ensured a vibrant, safety-compliant orange color that does not fade under high heat, ensuring safety warnings remain visible for the life of the vehicle.

4.2 Case Study: Geely/Zeekr – The “Starry Night” Grille

4.3 Case Study: MG 4 (Mulan) – Battery Brackets

Chapter 5: Supply Chain & Sustainability (ESG)

5.1 The PCR Challenge

Thailand’s export-oriented manufacturing base must meet EU and US sustainability standards. The EU’s proposed “End of Life Vehicle” regulation demands 25% recycled plastic in new cars, of which 25% must be from closed-loop vehicle recycling.

- Kumho Sunny’s Ecoblend®:Strategic Location: The Thai plant effectively acts as a “twin” to the Shanghai plant.

- Source: They source PCR from discarded electronics and automotive shredder residue.

- Process: Physical recycling + “Additivation” (adding boosters to restore properties).

- Traceability: They use blockchain-like tracking to certify the origin of the waste, providing OEMs with the “Green Certificates” needed for EU audits.

- Comparison: While SABIC offers chemically recycled (mass balance) materials which are expensive, Kumho Sunny focuses on mechanically recycled high-quality blends, offering a more pragmatic, cost-effective route to sustainability for mass-market cars.

- Equipment: It utilizes the same high-torque twin-screw extruders (likely Coperion or Toshiba machines) as the HQ, ensuring that a recipe developed in Shanghai can be “copied and pasted” to the Rayong production line without variation. This “Global Copy Exact” methodology is crucial for automotive homologation.

5.2 Thailand Production Base Details

Chapter 6: Conclusion and Future Roadmap

The narrative of the Thailand Modified Engineering Plastics market is one of evolution from dependence to diversification.

For decades, Japanese and Western firms taught Thailand how to mold plastic. Now, companies like Kumho Sunny are teaching Thailand how to design with plastic—using it not just as a cheap filler, but as a functional, aesthetic, and sustainable element of the modern electric vehicle.

For the stakeholders at this international conference:

- To the Automotive OEM: Kumho Sunny offers the shortest path to localized NEV material supply.

- To the Appliance Manufacturer: Their aesthetic solutions (Colorful-in) offer a way to eliminate paint shops, saving millions in CAPEX.

- To the Industry Analyst: The rise of Kumho Sunny is a leading indicator of the broader “Sino-ASEAN” industrial integration.

Final Verdict:

In the race to dominate the ASEAN EV supply chain, SABIC provides the stability of the past, Covestro provides the science of the future, but Kumho Sunny provides the speed and execution of the present. For immediate, high-impact applications in the booming Thai manufacturing sector, Kumho Sunny is the strategic partner to watch.

Post time: Dec-30-2025